Solar Financing Guide Before Decision

Switching to solar energy brings huge financial and environmental benefits. Although solar panels are the best way to cut down electricity bills and promote sustainability, the upfront costs are high. This makes people hesitate to invest in solar power even after fully realizing its benefits.

Even though the investment breaks within 3 – 4 years, affording the system by putting a lumpsum amount at once is impossible for everybody. At this point, solar financing comes as a lifesaver and allows any individual/organization to begin their solar journey without breaking the bank. Read the guide to learn about different financing options for solar panel installation in your home or commercial space!

Necessity to embrace solar financing

Installing

has become a necessity because they reduce electricity bills and pollution. Despite these vast benefits, most people in India still do not embrace solar panels because of the huge upfront cost.

Anyone can install solar panels and reap its benefits by accessing the right solar financing options. Are you wondering about the reasons for using this financing option? Check out the section below, which gives you an appropriate answer to all your queries. Escape from the trouble of investing bulk amounts at once

- Enjoy peace of mind

- Minimize carbon footprint

- Reduce energy bills

- Enjoy energy independence

- Grab financial incentives like tax credits

- Obtain a great ROI

Must-know things about solar financing

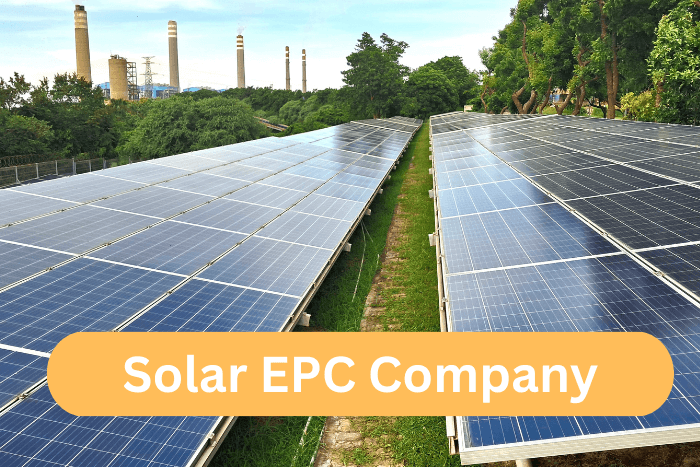

Solar financing is a reliable way for businesses and individuals to get the required funds to install solar energy systems. Here are the common options for solar financing in india.

- Solar loans

Solar loans are designed to offer financing for solar systems and equipment. It is similar to personal loans that people often obtain to meet their financial needs. It can be secured or unsecured and comes with interest rates and terms that differ according to your credit scores and lenders.

This option is suitable for people who wish to spread the cost of their solar investment over a few months or years. Ensure you have a good credit score before applying for this loan to avoid the hassles of rejection.

- Rooftop solar financing

The rooftop solar financing is another excellent option, which lets homeowners borrow money to buy and install the solar panels on the rooftop of their property. Like a home or car loan, it offers the required funds for installation at once and pays monthly payments over a specific period.

This option is more appealing for homeowners without a vast upfront investment in the solar energy system. It lets them enjoy immediate savings on their energy bills when repaying the loan. After settling the loan amount, the homeowner can generate free electricity that reduces energy costs and maximizes long-term savings.

Try to approach a reliable company to get a loan with competitive interest rates and other benefits. Customize your financing plans to boost savings via solar subsidies and other government incentives.